January 2026

- Jan 28

- 9 min read

HOW WILL AI TRANSFORM THE WORKPLACE? EMPLOYERS WEIGH IN

Rapid developments in artificial intelligence (AI) have left workers wondering when their jobs might be significantly affected or even eliminated. One international survey found that it won’t be long — 86% of employers across the globe expect AI and other information technologies to transform their businesses by 2030. Here are the top strategies employers surveyed expect to adopt within the next five years to leverage AI in the workplace.

Source: World Economic Forum, 2025

SOCIAL MEDIA TAKE A TOLL ON TEENS' MENTAL HEALTH

In a recent survey, nearly half of teens ages 13–17 said social media has a “mostly negative” effect on people their age, though fewer believe that it affects them personally. Girls, however, are more likely than boys to say that social media harms their mental health (25% vs. 14%) and confidence (20% vs. 10%).

Many parents and teens said they are at least somewhat concerned about youth mental health these days (89% and 77%, respectively), but teens point to a slightly different set of negative influences.

Source: Pew Research Center, 2025

A PENSION FREEZE CAN REDUCE RETIREMENT INCOME

Employer-sponsored pension plans are intended to provide a specific amount of retirement income to employees. But providers are increasingly deciding that funding these plans is no longer economically feasible. For this reason, pension freezes have become a topic of concern among employees who are counting on a pension to help fund their retirement.

How will a pension freeze affect you? Benefits that have already been accrued will remain available at your retirement. However, if your pension is frozen, you will no longer accrue additional pension benefits going forward. Basically, the estimated pension amount determined at the time the pension is frozen will remain the same no matter how long you continue to work for the employer.

If your pension is frozen, what are your options? Often, if your pension is frozen, the employer may offer the option to take your pension as a lump sum instead of receiving a monthly payment throughout retirement. If you accept the lump sum, you may roll that amount into a tax-qualified plan, such as an IRA or a new employer’s plan (if allowed by the plan). There will be no income taxes or penalties if you do the rollover properly, and your funds will continue to potentially benefit from tax-deferred growth.

However, you would assume responsibility for investment options and performance. Thus, it is important to be aware that you will probably have to rely more on your own savings and investments to fund your retirement. If your pension plan has been frozen, this would be a good time to reevaluate your retirement objectives.

Distributions from traditional IRAs and most employer-sponsored retirement plans are taxed as ordinary income, except for any after-tax contributions you’ve made, and the taxable portion may be subject to a 10% federal tax penalty if taken prior to reaching age 59½ (unless an exception applies). If you participate in both a traditional IRA and an employer-sponsored plan, your IRA contributions may or may not be tax deductible, depending on your adjusted gross income. All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

DON'T TAKE THE BAIT: TOP TAX SCAMS IN 2025

As tax filing season approaches, the IRS warns taxpayers to watch for scams that can cause identity theft, financial loss, or criminal penalties. The agency’s “Dirty Dozen” list, published annually since 2002, highlights 12 common tax schemes.

Phishing and smishing: Fake emails and texts that appear to be from the IRS or other tax agencies lure you into disclosing your personal and financial data.

Bad social media advice: Social media platforms circulate inaccurate tax tips that can lead to improper filings or disclosure of sensitive personal data.

IRS Individual Online Account help from scammers: Third parties pose as “helpful” guides who offer to set up IRS online accounts for you but instead steal your identity or file fraudulent returns.

Fake charities: Fraudulent charities prey on your goodwill to steal your donations and personal information.

False Fuel Tax Credit claims: Scammers who encourage you to improperly file a Fuel Tax Credit claim, which is not available to most taxpayers.

Credits for Sick Leave and Family Leave: Employees following bad advice have been improperly claiming a pandemic-era tax credit available only to self-employed individuals. This credit is no longer available.

Bogus self-employment tax credit: Social media posts that promote a nonexistent self-employment tax credit to entice you into filing a fraudulent claim.

Improper household employment taxes: Fraudsters convince you to file for fictional household employees to claim a refund based on false sick and family medical leave wages that you never paid.

The overstated withholding scam: Social media messaging that encourages you to fabricate large income and withholding amounts through W-2s, 1099s, and other forms to inflate refunds.

Misleading Offers in Compromise: Promoters, or “mills,” that misrepresent the federal tax debt relief program to trick you into paying fees for resolutions for which you do not qualify.

Ghost tax return preparers: Unscrupulous tax professionals who prepare returns without signing them or providing their IRS Preparer Tax Identification Number as required by law, subjecting you, the taxpayer, to potential tax fraud claims.

New client scams and spear phishing: Cybercriminals who impersonate clients in an email to trick tax professionals into responding to access sensitive client information.

To help avoid scams, the IRS recommends never clicking on unsolicited links purporting to be from the IRS, verifying charities before donating, and only working with trusted tax professionals to potentially protect your personal information.

KEY RETIREMENT AND TAX NUMBERS FOR 2026

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are some of the key adjustments for 2026.

Estate, gift, and generation-skipping transfer tax

The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2026 is $19,000, unchanged from 2025.

The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2026 is $15,000,000, up from $13,990,000 in 2025.

Standard deduction A taxpayer can generally choose to itemize certain deductions or claim a standard deduction on the federal income tax return. In 2026, the standard deduction is:

$16,100 (up from $15,750 in 2025) for single filers or married individuals filing separate returns

$32,200 (up from $31,500 in 2025) for married joint filers

$24,150 (up from $23,625 in 2025) for heads of households

The additional standard deduction amount for the blind and those age 65 or older in 2026 is:

$2,050 (up from $2,000 in 2025) for single filers and heads of households

$1,650 (up from $1,600 in 2025) for all other filing statuses

Special rules apply for an individual who can be claimed as a dependent by another taxpayer.

The One Big Beautiful Bill Act, signed into law in July 2025, introduced a new senior deduction of $6,000 for taxpayers filing individually who are age 65 or older for tax year 2026. A deduction of up to $12,000 may be claimed by married couples filing jointly if they are both age 65 or older.

This deduction is stacked on top of the standard deduction and additional deduction for the blind and those age 65 or older or on top of itemized deductions.

IRAs The combined annual limit on contributions to traditional and Roth IRAs is $7,500 in 2026 (up from $7,000 in 2025), with individuals age 50 or older able to contribute an additional $1,100 in 2026 (up from $1,000 in 2025). The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges (see table). For individuals who are active participants in an employer-sponsored retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges (see table). The limit on nondeductible contributions to a traditional IRA is not subject to phaseout based on MAGI.

Note: The 2026 phaseout range is $242,000–$252,000 (up from $236,000–$246,000 in 2025) when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered. The phaseout range is $0–$10,000 when the individual is married filing separately and either spouse is covered by a workplace plan.

Employer-sponsored retirement plans

Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $24,500 in compensation in 2026 (up from $23,500 in 2025); employees age 50 or older can defer up to an additional $8,000 in 2026 (up from $7,500 in 2025). For employees ages 60 to 63, the additional deferral limit is $11,250 for 2026 (unchanged from 2025).

Employees participating in a SIMPLE retirement plan can defer up to $17,000 in 2026 (up from $16,500 in 2025), and employees age 50 or older can defer up to an additional $4,000 in 2026 (up from $3,500 in 2025), with an increase to $5,250 in 2026 (unchanged from 2025) for ages 60 to 63.

Kiddie tax: child’s unearned income Under the kiddie tax, a child’s unearned income above $2,700 in 2026 (unchanged from 2025) is taxed using the parents’ tax rates.

Q AND A ON RMDs

Tax-deferred retirement savings accounts, including IRAs and employer-based plans, are an appropriate way to build assets. Your accounts can potentially grow without losing ground to income taxes each year, and depending on the account type and your income level, you may also benefit from a tax deduction for your contributions.

However, with traditional, non-Roth accounts, you can’t defer taxes indefinitely. The IRS will eventually get its share through what’s known as required minimum distributions (RMDs).1

What are RMDs? RMDs are annual distributions that must be taken from traditional, non-Roth IRAs and employer plans once you reach a certain age. If you were born from 1951 to 1959, you must begin RMDs after you reach age 73. If you were born in 1960 or later, your RMD age is 75. There is one exception to this rule: If you work beyond RMD age and you’re not a 5% owner of your company, you can defer RMDs from your current employer’s plan until you retire. You’ll still be required to take RMDs from any previous employer plans.

Which accounts are subject to RMDs? Traditional IRAs, SEP IRAs, SIMPLE IRAs, SARSEPS, and all work-based retirement plans — including 401(k), 403(b), 457(b), and profit-sharing plans — are all subject to RMDs.

How much must I withdraw? RMDs are calculated based on the value of your account as of the previous December 31, divided by a life expectancy factor published in tables included in IRS Publication 590-B.

There are three different tables, each of which applies to certain situations.

For example, say you reach age 73 in 2026 and your work-based retirement plan account was worth $750,000 on December 31, 2025. Assuming you use Table III, the Uniform Lifetime table, your plan account RMD for 2026 would be $28,302 ($750,000 ÷ 26.5).

You must calculate RMDs for each account you own. With IRAs, the IRS allows you to total all RMD amounts and take your distribution from one IRA. Similar rules apply to 403(b) plans. With other work-based plans, you must calculate your RMD and take a distribution separately from each account.

You can always withdraw more than the required amount in any given year.

How do RMDs affect my income taxes? RMDs (except amounts that were previously taxed, i.e., non-deductible contributions) are reported as taxable income. Consequently, a large RMD could result in a sizeable tax obligation.

Generally, you must take RMDs by December 31 each year; however, you may delay your first RMD until April 1 of the year following the year you reach RMD age. Keep in mind that your second RMD will still be required by December 31 of that same year, which could significantly increase your income taxes.

In addition, neglecting to withdraw the required amount can result in a penalty tax of 25% of the difference between what you should have withdrawn and the actual distribution. This amount may be reduced to 10% or even waived entirely if corrected as soon as possible within two years (see IRS Form 5329 and associated instructions).

One way to satisfy your annual IRA RMD without increasing your tax burden is to make a qualified charitable distribution (QCD). A QCD is a charitable contribution made directly from your IRA trustee to a qualified charity of your choice. Although QCDs are not tax deductible, you can exclude up to $111,000 in 2026 ($222,000 if you’re married filing jointly) in QCDs from your gross income.2

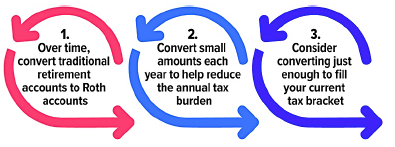

Another Tax Strategy: Consider Roth Conversions

Roth conversions are taxable events, but they may help reduce RMDs later. How they work:

Taxes owed are payable in the year of conversion.

1) Unlike traditional accounts, Roth accounts don’t offer tax-deductible contributions. Withdrawals from traditional accounts prior to age 59½ and non-qualified withdrawals from Roth accounts are subject to ordinary income taxes and a 10% early distribution penalty, unless an exception applies. Qualified withdrawals from Roth accounts are those made after a five-year holding period and the participant reaches age 59½, dies, or becomes disabled. Roth accounts are not subject to RMDs during the account owner’s lifetime, but most Roth account beneficiaries, like traditional account beneficiaries, are subject to highly complex RMD rules beyond the scope of this article. For more information, speak with a tax professional.

2) QCDs are not permitted from employer plans.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Spire Wealth Management, LLC is a Federally Registered Investment Advisory Firm. Securities offered through an affiliated company, Spire Securities, LLC., a Registered Broker/Dealer and member FINRA/SIPC.

Neither Spire Wealth Management nor Corbett Road Wealth Management provide tax or legal advice. The information presented here is not specific to any individual’s personal circumstances. Please speak with your tax or legal professional.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This content has been reviewed by FINRA.

Prepared by Broadridge Advisor Solutions. © 2026 Broadridge Financial Services, Inc.